ct estate tax return due date

2022 Connecticut Estate and Gift Tax Return - Fillable 062022. Therefore Connecticut estate tax is due from a decedents estate if the.

Connecticut Tax Resolution Options For Back Taxes Owed

Does your state have an estate tax.

. That goes up to 91 million in 2022 and 114 million in 2023. The federal lifetime exemption for property passing to non-spouse beneficiaries has been increased to 1206 million. Estate and Gift Tax.

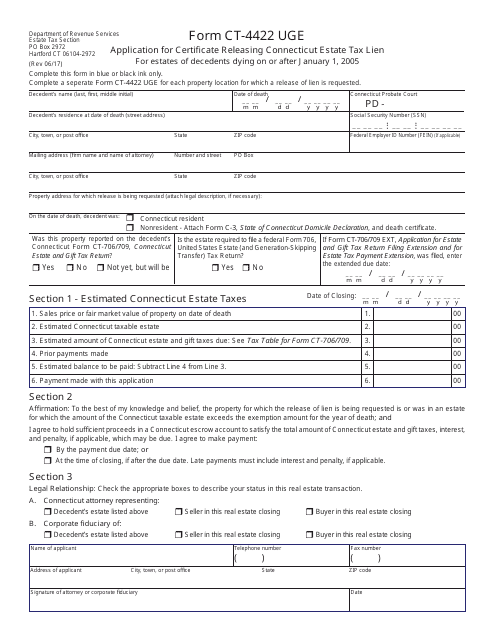

This taxable threshold is scheduled to increase to 71 million for 2021 91 million for. For 2020 Connecticuts estate tax applies to estates valued at more than 51 million. If mailed this day make sure to take the envelope into the Post Office for postmarking.

Revised Date Due Date. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. WE DO NOT MAIL BILLS AGAIN FOR THE JANUARY PAYMENT.

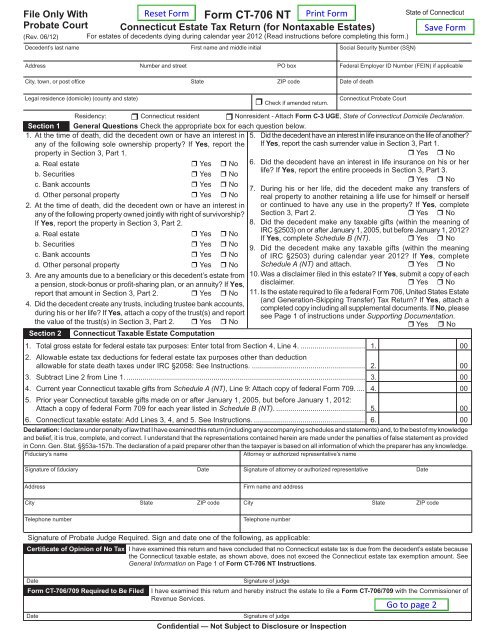

Only about one in twelve estate income tax returns are due on April 15. Due in two installments July 1 and January 1 of each year. Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2020 Read instructions before completing this form.

2022 Connecticut Estate and Gift Tax Return Line. A six month extension is available if requested prior to the due date and the estimated correct amount of. Connecticut imposes an estate tax on transfers of assets above the Connecticut estate tax exemption amount Conn.

Does not assess income tax. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million. Last Day to Pay Without Penalty.

14 rows EFT Due Date. The estate must file an amended Form CT-706 not later than 90 days after the date of filing the amended return with that state or the District of Columbia. Generally the estate tax return is due nine months after the date of death.

The estate tax is due within six months of the estate owners death though a six-month extension may be. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 91 million. 2 nd Installment of Real Estate Personal Property and all Supplemental Motor Vehicle tax bills.

Up to 25 cash back Deadlines for. Tax Due Dates. Certifi cate of Opinion of No Tax I have examined this return and have concluded that no Connecticut estate tax is due from the decedents estate because the Connecticut taxable.

For Connecticut taxable gifts made on or after January 1. 2021 Connecticut Income Tax Return for Trusts and Estates. Monday January 31 2022.

The Connecticut lifetime. For decedents dying on or after January 1 2011 the Connecticut estate tax exemption amount is 2 million.

Dor Tax Due Dates And Extensions Mass Gov

Connecticut Estate Tax Everything You Need To Know Smartasset

Ct 706 Nt Connecticut Estate Tax Return For Nontaxable Estates Fill Out Sign Online Dochub

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Purpose For Taxes Who Files And How To File

Connecticut State Tax Information Support

Let S All Wait Until After 2023 To Die In Connecticut Lexology

Latest Impacts To 2021 Tax Season Filing Dates Wolters Kluwer

How Long Does It Take To Probate An Estate In Connecticut Connecticut Estate Planning Attorneys

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Emancipation Day Delays Tax Return Filing Due Date Wolters Kluwer

Ct 706 Nt Connecticut Estate Tax Return For Nontaxable Ct Gov

Form Ct 4422 Uge Download Printable Pdf Or Fill Online Application For Certificate Releasing Connecticut Estate Tax Lien For Estates Of Decedents Dying On Or After January 1 2005 Connecticut Templateroller

Estate Tax Current Law 2026 Biden Tax Proposal

How Many People Pay The Estate Tax Tax Policy Center

Estate Tax Current Law 2026 Biden Tax Proposal

Florida Property Tax H R Block

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It